-

Want to level up your HSC prep for Maths? Click here for details and register for the BoS Trials now!

Make a Difference – Donate to Bored of Studies!

Students helping students, join us in improving Bored of Studies by donating and supporting future students!

Housing affordability SYDNEY (1 Viewer)

- Thread starter Harvard

- Start date

spatula232

Active Member

It'll pop eventually. As long as there is demand for housing though, it'll keep going. Demand and supply at its finest

RenegadeMx

Kosovo is Serbian

- Joined

- May 6, 2014

- Messages

- 1,301

- Gender

- Male

- HSC

- 2011

- Uni Grad

- 2016

there gonna drop very soonDoes anyone know what's going to house prices once they peak? At this rate, will they keep increasing or will the bubble pop?

isildurrrr1

Well-Known Member

- Joined

- May 13, 2013

- Messages

- 1,755

- Gender

- Undisclosed

- HSC

- N/A

The only time sydney property prices dropped was due to the GFC. They only dropped 5%.It'll pop eventually. As long as there is demand for housing though, it'll keep going. Demand and supply at its finest

Sydney market would have a slowdown and growth is going to slow. It's a major supply problem and honestly there's not enough housing. Govts will ALWAYS prop up housing prices. Their major asset wealth and have huge implications to the economy if housing prices fall. Look at what happened in the US, housing crash caused their ENTIRE economy to tank.

If you compare sydney to other major cities in the world with housing proximity to the city and actually have your own houses, sydney prices are quite cheap.

Not only that, australian banks have very strict lending rules (LVI's, equity protection and mortgage insurances etc) that prevent housing prices from falling.

It's much cheaper to rent anyway now if you compare prices to rent in the area. Landlords are crying for good tenants now since there has been a major supply growth in the past 2-3 years.

isildurrrr1

Well-Known Member

- Joined

- May 13, 2013

- Messages

- 1,755

- Gender

- Undisclosed

- HSC

- N/A

yeah, after having double digit growth for 2 years straight.It's already starting to drop a little

Sent from my D6503 using Tapatalk

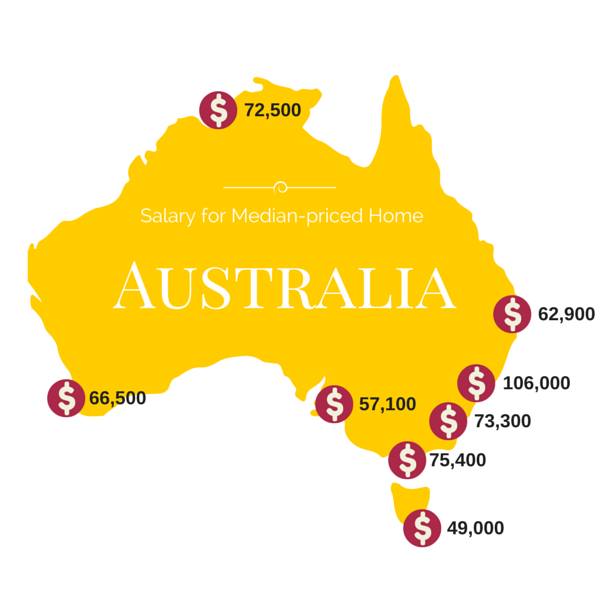

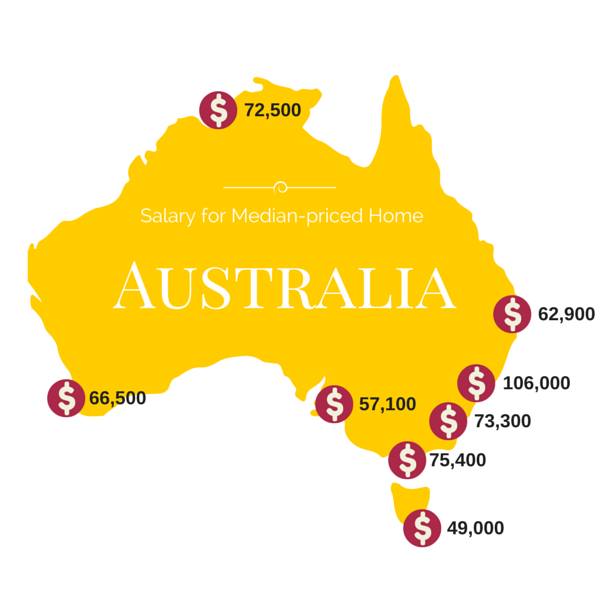

You need over 100k wage to buy a house in Sydney -

Attachments

-

21.4 KB Views: 32

isildurrrr1

Well-Known Member

- Joined

- May 13, 2013

- Messages

- 1,755

- Gender

- Undisclosed

- HSC

- N/A

you have to do a lot of research. you just have to buy 'at the right price' and don't get into a fear of missing out and overpay for the value.If you have saved the money for a deposit on an apartment/house, is it still competitive/difficult to buy a house? e.g. would you be competing against other people who want to buy that house and is the competition fierce

A lot of people lost or haven't made any capital gains because they paid above market price at the time.

The biggest mistake people make when buying a house is an emotional attachment. A lot of people think that 'oh doesn't matter about the price coz i live in it'. That's a dumb way to look at it. A house is an asset whether you like it or not and why would you not live in an asset that would be growing?

People are stupid at looking at only off the plan pricing. There's two bedders selling for 800k+ off the plan in western suburbs, when you can get a better place in the north shore for the same price.

London is even worst

http://www.theguardian.com/business...s-need-to-earn-77000-a-year-to-live-in-london

77k pounds a year, which is roughly 150k aud per year.

isildurrrr1

Well-Known Member

- Joined

- May 13, 2013

- Messages

- 1,755

- Gender

- Undisclosed

- HSC

- N/A

Wrong. Just because people have family or funds overseas doesn't make them foreigners. Even FIRB for off the plan properties aren't even more than 20% of total off the plan sales. After all, 25% of aussie citizens are born overseas. Not exactly hard to have overseas networks. The reason why housing prices have been on the rise recently is mostly because of lowering interest rates and lack of supply. You got cheap credit flooding the market with a demand outstripping supply which naturally causes prices to rise.Majority of houses are being bought by foreigner's as investments so demand is high and supply is demand, houses are competitive.

isildurrrr1

Well-Known Member

- Joined

- May 13, 2013

- Messages

- 1,755

- Gender

- Undisclosed

- HSC

- N/A

rent in where you want to live and buy in where you can have dem capital gains.

Chronost

Ex CAG auditor - current CAG deal-maker

The Chinese are buying up investment properties trust me, but not the average housing, it's more parts of whole apartments in popular areas like the CBD and North Shore or high tier houses - a lot of these are bought through a subsidiary, family here etc.. so whilst stats say they aren't bought by them, they actually are

This is through talking to some CFO's of major property buyer and sellers + lawyers and tax (and they all say the same thing of where a lot of their work (and $$$) is currently coming from)

This is through talking to some CFO's of major property buyer and sellers + lawyers and tax (and they all say the same thing of where a lot of their work (and $$$) is currently coming from)

Chronost

Ex CAG auditor - current CAG deal-maker

If you're planning to live in a house for 5,10,15 years or even likely your whole life time and you see that it fits your description in everywhere, why wouldn't you want to pay a bit more for comfortable living - I would not pay 50-100k less just to live in a house with maybe slightly better growth prospects but knowing you'll be renovating it either way some time in the future cause you don't like this or that. Everyone has their own plans in mind with things like family, convenience etc.., it's not as simple as looking at it from a growth prospective, that's what you look for in an investment property instead.you have to do a lot of research. you just have to buy 'at the right price' and don't get into a fear of missing out and overpay for the value.

A lot of people lost or haven't made any capital gains because they paid above market price at the time.

The biggest mistake people make when buying a house is an emotional attachment. A lot of people think that 'oh doesn't matter about the price coz i live in it'. That's a dumb way to look at it. A house is an asset whether you like it or not and why would you not live in an asset that would be growing?

People are stupid at looking at only off the plan pricing. There's two bedders selling for 800k+ off the plan in western suburbs, when you can get a better place in the north shore for the same price.

London is even worst

http://www.theguardian.com/business...s-need-to-earn-77000-a-year-to-live-in-london

77k pounds a year, which is roughly 150k aud per year.

isildurrrr1

Well-Known Member

- Joined

- May 13, 2013

- Messages

- 1,755

- Gender

- Undisclosed

- HSC

- N/A

There's major implications when buying in an area that isn't growing. For one you're putting money into essentially a depreciating asset. Secondly, its much much harder to get an equity loan.If you're planning to live in a house for 5,10,15 years or even likely your whole life time and you see that it fits your description in everywhere, why wouldn't you want to pay a bit more for comfortable living - I would not pay 50-100k less just to live in a house with maybe slightly better growth prospects but knowing you'll be renovating it either way some time in the future cause you don't like this or that. Everyone has their own plans in mind with things like family, convenience etc.., it's not as simple as looking at it from a growth prospective, that's what you look for in an investment property instead.

Nowadays NOBODY is going to live in the 'same area' for the next 10 years. You can always elect to sell your house and move. It makes the latter much more difficult when people's housing have gone up and yours have done zilch.

And so what? I find it funny the Chinese are being singled out when most australians have families overseas. How many friends are willing to give their mate or family member money to invest in housing where they have 0 legal title and claim. There is quite a few purchases by new citizens/PRs who have parents from overseas who are buying property for their children. How is that any different than an aussie family whose doing the exact same thing? in fact it's BETTER for Australia since there's more capital inflows to the country.a lot of these are bought through a subsidiary, family here etc.. so whilst stats say they aren't bought by them, they actually are

seremify007

Junior Member

The way I see it is if you're going to pay $x per month renting, then how much more would you have to pay to make mortgage payments - keeping in mind the inherent risks attached with owning a place as well as the additional costs (e.g. strata) which you may not have budgeted for. The upside of course being you get to own something one day or at least if you go to move, you have some equity to sell (however little that may be).

Whilst my property value has gone up (I bought a one bedroom apartment with parking in the Sydney CBD), the replacement price is also high so I don't stand to realise the gain as I still need another place to live making it a bit of a moot point though.

Whilst my property value has gone up (I bought a one bedroom apartment with parking in the Sydney CBD), the replacement price is also high so I don't stand to realise the gain as I still need another place to live making it a bit of a moot point though.